If you work in finance and haven’t heard some version of “AI is coming for your job,” congrats on living under a rock—must be peaceful down there.

The headlines are relentless: AI to replace 800 million jobs, robots to eliminate accountants, finance pros face extinction. The fear is thick enough to balance a P&L on. But as someone knee-deep in forecasting models and month-end madness, I’m here to tell you: the truth is a little more nuanced (and a lot less apocalyptic).

Let me take you back to last quarter. I was buried in variance analysis, trying to make sense of a messy data dump from three different systems that don’t speak the same language (classic). I threw the mess into ChatGPT on a whim—just to see if it could help with a quick summary. In under a minute, it spit out something that would’ve taken me an hour to clean and narrate. Cue the existential dread.

For about 30 seconds, I genuinely wondered if I’d just automated myself out of relevance. But here’s the thing: the output was solid… until it wasn’t. No context, no judgment, no understanding of why sales dipped or why OPEX was spiking in that one rogue cost center. That’s where I stepped back in—with insight, experience, and a healthy dose of side-eye toward bad data. AI can handle data, but it lacks the financial expertise required for nuanced decision-making.

So will AI replace finance jobs? Not exactly. It’s transforming them. Automating the grunt work. Augmenting the analysis. For the sharp, adaptable finance pro, AI isn’t a threat—it’s a force multiplier.

The Automation Avalanche

Let’s be honest—finance has always had its fair share of soul-sucking tasks. The kind of work that makes you question your life choices at 11:47 PM on day three of close. The good news? That’s exactly the type of work artificial intelligence is targeting by automating routine tasks.

AI automation is increasingly taking over manual and repetitive tasks like financial data entry and reconciliation, allowing finance professionals to focus on more strategic and high-value work.

Routine and Repetitive Tasks on the Chopping Block

If your job is 80% Ctrl+C, Ctrl+V, and crossing your fingers that Excel doesn’t crash—yeah, it’s time to rethink your workflow. Here’s what AI is already bulldozing:

- Data Entry and Reconciliation AI can match thousands of records in seconds without whining or needing coffee. Bank recs? Subledger rollups? You don’t need an intern for that anymore—you need a bot.

- Basic Reporting Those weekly reports where you copy data from four systems, paste into a “template,” refresh pivots, and pray everything lines up? AI can automate tasks to auto-generate them and even narrate what changed.

- Routine Compliance Checks Think audit trails, flagging anomalies, or running through SOX controls. Machine learning models don’t sleep, and they don’t overlook the $30k rounding error you swore was “immaterial.”

Case Study: IBM Pulled the Trigger

Let’s zoom out for a second. IBM’s HR division recently made headlines for replacing hundreds of jobs with AI agents. But here’s the kicker—they didn’t just cut and walk. They reallocated those resources into programming, data science, and customer-facing roles. They repurposed talent instead of trashing it, leveraging AI to enhance their efficiency by automating routine tasks and optimizing costs. Source: TechRadar

That’s the pattern. AI wipes out repetitive admin work—then companies shift people into higher-value roles. It’s not about replacing humans with robots. It’s about offloading the junk work so the humans can finally breathe (and strategize). By automating financial processes such as data entry and transaction processing, companies can streamline operations and improve overall efficiency.

Real Talk: What This Means for Us

AI’s sweet spot is rules-based, repeatable, and predictable. The stuff you dread doing? It’s already halfway to being automated. And that’s not a bad thing.

This isn’t the apocalypse—it’s a long-overdue cleanup. AI is the intern who never takes lunch and actually wants to do the boring stuff. Our job now? Stop hoarding tasks we hate out of fear, and start looking at how we can move upstream.

Because if you’re still spending your time updating 27 tabs in Excel by hand… AI isn’t the threat. It’s the rescue boat you’ve been ignoring.

The Human Edge in Finance

Let’s set the record straight: AI can crunch numbers, sort data, and even write a half-decent summary. But you know what it can’t do?

Navigate a messy board meeting with half the facts, read between the lines of a CFO’s offhand comment, or decide whether it’s worth nuking a vendor relationship over a sketchy invoice. That, my friend, still takes human expertise.

When it comes to financial decision making, AI can analyze data, but it is the human element that interprets this data within a broader ethical and regulatory framework. This ensures responsible and informed investment choices are made, highlighting the indispensable role of human judgment.

Irreplaceable Skills of Finance Professionals

Here’s where we still hold the high ground—and it’s not just wishful thinking:

- Critical Thinking and Judgment AI can tell you what happened, but human professionals figure out why it matters. It’s not just about the numbers—it’s what they mean in the real world, with context, tradeoffs, and consequences.

- Emotional Intelligence and Client Relationships Machines don’t pick up on body language, sarcasm, or that weird energy in a QBR when the numbers are off. Humans do. That’s how deals are won and careers are made.

- Ethical Decision-Making When AI flags a borderline transaction, it doesn’t weigh reputational risk or regulatory nuance. It doesn’t think about gray areas—it only sees 1s and 0s. That’s where ethics and leadership step in.

Expert Insight: The EPOCH Framework

According to a March 2025 study from researchers at MIT and Harvard, AI still flops at anything involving:

Empathy, Presence, Opinion, Creativity, and Hope—a.k.a., the EPOCH framework.

Source: arXiv preprint

Translation? AI might be fast, but it’s emotionally bankrupt. It doesn’t “get” people. That’s a problem in a profession where relationships, persuasion, and judgment calls can make or break your impact.

Real-World Example: Banking on Human Grit

Take investment banking. Everyone loves to joke that Excel runs the show—and sure, AI can spit out discounted cash flows all day long. But junior bankers still grind 80-hour weeks, not because AI can’t do the math, but because insight is earned through understanding financial markets.

Reading a room. Knowing when to push back on a deal term. Understanding that the numbers say one thing, but the market’s appetite says another? That’s not in the code and requires human involvement.

As the Financial Times recently noted: AI might save time, but it can’t replace the instincts that come from experience in high-stakes environments. Source: FT.com

AI as a Collaborative Tool

Let’s kill the “AI vs. humans” narrative right now. The smartest finance teams aren’t replacing analysts with algorithms—they’re giving their analysts superpowers through AI-generated insights. These insights enable finance professionals to move away from mundane tasks towards more strategic decision-making.

This isn’t Skynet. It’s Iron Man. The suit doesn’t replace Tony Stark—it just makes him unstoppable by providing strategic guidance.

Augmentation, Not Replacement

AI shines when it’s not trying to take your job—but instead helping you do it faster, better, and with fewer midnight meltdowns. Here’s how it’s stepping in to integrate AI into your workflow:

- Data Analysis AI can chew through massive datasets in seconds and interpret market trends most of us would miss between our third and fourth cup of coffee, significantly enhancing financial operations.

- Forecasting Machine learning models spot patterns in historical data and suggest future outcomes—like having a junior analyst who never forgets what happened three fiscal years ago, thereby improving financial operations.

- Risk Assessment AI can flag anomalies, scan for regulatory issues, and run “what-if” scenarios without breaking a sweat. It’s like having your own internal risk radar running 24/7.

Case Study: Bloomberg’s Not Replacing—They’re Supercharging

Bloomberg’s tech chief, Shawn Edwards, put it bluntly: “The technologists are the rock stars now.”

They’ve embedded AI across the board—from parsing real-time financial news to building predictive analytics tools that help analysts make faster, sharper decisions.

But here’s the key: they didn’t gut the team. They armed the team.

Source: Financial News London

Think of it like this: Analysts still drive the car. AI is just upgrading the GPS, adding lane assist, and occasionally whispering, “Hey, maybe don’t miss that revenue spike on page 12.”

The Evolving Job Landscape

Yes, some roles are disappearing. No, it’s not time to panic.

The finance world isn’t going extinct—it’s going through puberty. Awkward, messy, transformative—but necessary. And just like puberty, some things shrink, others grow, and your priorities shift along the way. The job market is evolving, with AI not only posing a threat of job displacement in finance roles but also creating new opportunities for finance professionals to adapt and enhance their skill sets.

This digital transformation within the finance sector, driven by the integration of advanced technologies like AI-driven chatbots and virtual assistants, is enhancing efficiency in managing routine tasks. It also improves the accessibility and consistency of customer interactions, signaling a broader move towards automation and innovation in financial services.

New Roles Emerging

As automation handles more of the grunt work, the org chart is getting a facelift. We’re seeing new seats open at the table—roles that didn’t exist a decade ago, and frankly, sound kind of badass:

- AI Compliance Officers Someone’s gotta make sure these models play by the rules. Enter the finance pro who knows their way around both regulatory frameworks and machine learning outputs.

- Data Ethicists When AI makes a sketchy call, who’s responsible? Spoiler: you are. These roles are popping up to guide ethical decision-making around algorithmic bias, data privacy, and the moral gray zones machines love to ignore.

- AI Strategy Consultants Part tech whisperer, part finance translator. These are the folks who connect the dots between automation tools and business value—without needing a 50-slide deck to explain it.

- Data Scientists As AI transforms finance roles, data scientists are becoming essential players. They merge financial acumen with strong programming capabilities, allowing finance professionals to engage in more strategic and creative functions.

To thrive in these new roles, finance professionals need to develop ai related skills. Companies are investing in AI training programs to ensure their workforce is adept at using AI-driven tools. Fostering a culture of continuous learning is crucial to enhance team capabilities and remain competitive in the evolving landscape.

The Stats Are Clear

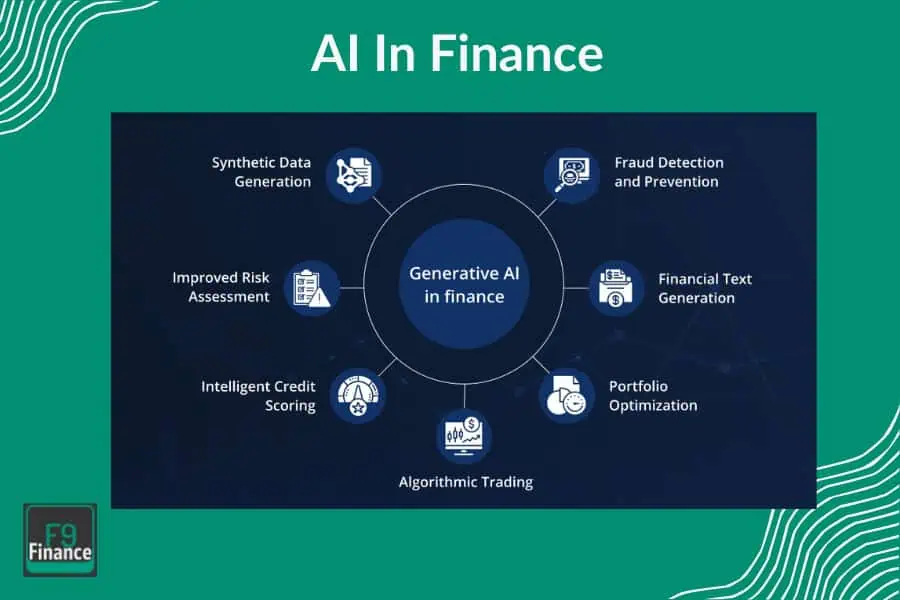

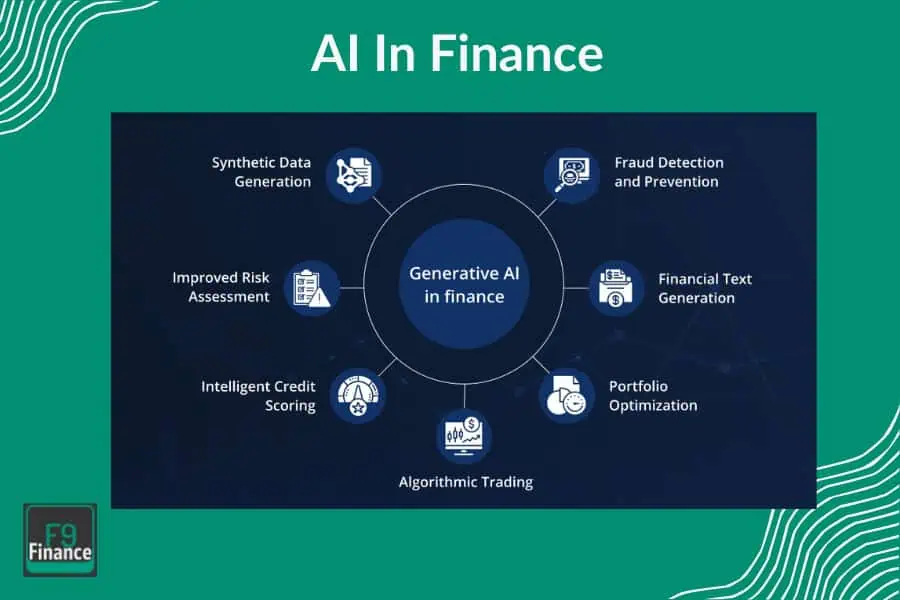

According to a recent Datarails CFO survey, 57% of CFOs expect AI to reduce finance roles by 2026. Sounds scary, right? The impact of AI on the financial sector is significant, reshaping efficiency and security through advancements like algorithmic trading and fraud detection.

But here’s the twist: most of those same CFOs also expect AI to unlock entirely new finance functions—stuff that’s more strategic, more analytical, and way less about babysitting spreadsheets. These advancements create opportunities for human expertise in financial decision-making, ensuring that while AI processes data, human professionals add value through their understanding of market dynamics and ethical considerations.

The job count may shift. But the opportunity? It’s exploding.

Insight: Evolve or Be Eclipsed

Here’s the cold truth: if your role is 100% repeatable, it’s already halfway to being automated.

But if you lean into adaptability—if you start thinking like a product manager for your own career—you’ll start spotting those next-gen opportunities before they’re even posted on LinkedIn.

The future isn’t about job security—it’s about skill liquidity. It’s not “will my job exist?” It’s “how fast can I evolve into the one that does?”

Benefits of AI in Finance

The benefits of AI in finance are nothing short of game-changing. Imagine automating routine and repetitive tasks like data entry and report generation, freeing up your time to focus on more strategic activities. AI can handle these mundane tasks with ease, allowing finance professionals to dive into financial modeling and portfolio management without the constant distraction of administrative work.

But the advantages don’t stop there. AI’s ability to analyze complex data and identify patterns means finance teams can make more informed investment decisions. This not only drives business growth but also enhances competitiveness in the finance industry. With AI, you’re not just keeping up with the market; you’re staying ahead of it.

Real-World Impact: Success Stories

Several financial institutions have already embraced AI, achieving remarkable improvements in efficiency, accuracy, and risk management. For instance, AI-powered systems are now being used to detect and prevent fraudulent activities like money laundering and terrorist financing. These systems can analyze vast amounts of data in real-time, flagging suspicious transactions before they become a problem.

Moreover, AI-driven tools have enabled finance professionals to outperform human traders in certain markets. By leveraging AI, these professionals can make quicker, more accurate financial decisions, driving financial performance and success in the finance sector. It’s clear that AI isn’t just a tool—it’s a catalyst for transformation.

Risk Management and AI

AI has also transformed the field of risk management, enabling finance professionals to identify and mitigate potential risks more effectively. Machine learning models can analyze vast amounts of data to identify patterns and anomalies, allowing risk managers to make more informed decisions about risk assessment and management. Imagine having a system that can monitor financial transactions in real-time, flagging potential risks and ensuring compliance with financial regulations before they escalate into major issues.

These AI-powered systems act as a 24/7 risk radar, enabling finance teams to respond quickly to potential threats. As AI continues to evolve, its role in risk management will only grow, providing finance professionals with the tools they need to navigate an increasingly complex financial landscape. By integrating AI into their risk management strategies, finance teams can drive business growth and maintain a competitive edge in the finance industry.

In conclusion, AI is not here to replace finance professionals but to empower them. By embracing AI and leveraging its capabilities, finance professionals can enhance their roles, drive innovation, and ensure their organizations remain competitive in a rapidly evolving industry.

Preparing for the AI-Enhanced Future

Alright—so AI’s not here to replace you. But it will outpace you if you sit still. This next chapter isn’t about fearing change—it’s about weaponizing it through continuous learning.

Think of AI like a power tool. Dangerous in the wrong hands. Magical in the right ones. Your job now? Become the kind of finance pro who embraces a growth mindset, knows how to wield it like a pro, not stare at it like it’s going to take your job and your lunch.

Skill Development: Stay Sharp or Get Replaced

The tools are evolving. Are you?

- Learn AI and Data Analytics You don’t need to become a Python wizard or build neural nets from scratch—but you do need to understand how AI models work, what makes data clean (or dirty), and how to ask better questions of your tools. Technical expertise in these areas is crucial, especially as AI integration becomes more prevalent in finance roles.

Start with Power BI. Learn Power Query. Dabble in ChatGPT prompts. You’ll be shocked how fast the productivity ROI shows up.

- Double Down on Human Skills AI can’t lead a meeting, build trust with a client, or navigate office politics without starting a civil war. Your EQ is your job security. Communication. Empathy. Influence. Those are the future-proof skills. Financial analysts, in particular, will continue to be indispensable due to their critical thinking and industry expertise, which AI cannot replicate.

Mindset Shift: From Threat to Teammate in AI Adoption

If you treat AI like an enemy, you’ll always be playing catch-up.

But if you treat it like your junior analyst—the one that never sleeps, never complains, and doesn’t steal your yogurt from the breakroom fridge—it becomes your secret weapon.

The real threat isn’t AI. It’s finance pros who refuse to adapt.

Action Steps: How to Start Winning With AI Now

Let’s keep it practical. Here’s how to start future-proofing your career this quarter:

- Identify One Tedious Task You Could Automate

Think: manual report updates, data cleansing, month-end prep. If it makes you want to throw your laptop, it’s a good candidate. - Find One Training Resource and Block 30 Minutes a Week

LinkedIn Learning, Coursera, a good YouTube rabbit hole—it doesn’t matter. The key is consistent reps. This is your new gym. - Volunteer for One Cross-Functional Project

Sit in with IT. Join a process improvement team. Hell, just ask to shadow someone using Power BI. Exposure breeds opportunity. - Build an “AI + Me” Routine

Try using ChatGPT to write a variance commentary draft. Use Power Query to pull your next dataset. Make AI part of your daily flow—not a novelty you save for “someday.”